In this post I would like to give you a brief overview of the concept of market definition in the aviation industry. First of all, the basic concept of market definition in the aviation industry does not differ, at least concerning the essential characteristics, from the general concept of market definition that is used in Competition Law all over the world. However, specific aspects and principles of the aviation sector have been adopted and utilized by competition authorities and courts for defining the relevant aviation market.

Starting point: Market definition

The first step in any competition analysis is the definition of the relevant market. There are two fundamental dimensions of market definition:

the product market; and

the geographic market.

Market definition takes into account both the demand and supply considerations. If markets are defined too narrowly in either product or geographic terms, significant competition may be excluded from the analysis. On the other side, if the product and geographic markets are too broadly defined, the degree of competition may be overstated. Too broad or too narrow market definitions lead to understating or overstating market share and concentration measures.

For more information see OECD, Glossary of Industrial Organisation Economics and Competition, paragraph 125

Commission Notice on the Definition of Relevant Market

“Market definition is a tool to identify and define the boundaries of competition between firms. It serves to establish the framework within which competition policy is applied by the Commission. The main purpose of market definition is to identify in a systematic way the competitive constraints that the undertakings involved face.”

According to section II paragraph 7 of the Notice ‘Relevant product markets‘ are defined as follows:

“A relevant product market comprises all those products and/or services which are regarded as interchangeable or substitutable by the consumer, by reason of the products’ characteristics, their prices and their intended use.”

Pursuant to section II paragraph 8 of the Notice ‘Relevant geographic markets‘ are defined as follows:

“The relevant geographic market comprises the area in which the undertakings concerned are involved in the supply and demand of products or services, in which the conditions of competition are sufficiently homogeneous and which can be distinguished from neighbouring areas because the conditions of competition are appreciably different in those area.”

ICN Recommended Practices

Another interesting source for market definition matters are the ICN Recommended Practices, for example the Recommended Practices for Merger Analysis or the Recommended Practices for Dominance Substantial Market Power Analysis Pursuant to Unilateral Conduct Laws. According to the ICN the purpose of market definition (in merger control) is to identify an appropriate frame of reference for assessing whether a merger may create or enhance market power. Therefore, competition agencies should assess the competitive effects of a merger within economically meaningful markets. With regard to the assessment of dominance / substantial market power (in unilateral conduct cases) the ICN states that competition agencies should use a sound analytical framework firmly grounded in economic principles in determining whether dominance / substantial market power exists.

Aviation-related situations in which it is necessary to define the relevant market

When determining whether an agreement between

aviation market actors has the appreciable effect of restricting competition (Article 101(1) TFEU)

When determining whether an agreement between aviation market actors has an appreciable effect on trade between Member States (Article 101(2) TFEU)

When determining whether an agreement between aviation market actors would substantially eliminate competition (Article 101(3)(b) TFEU)

When determining whether an aviation undertaking has a dominant position (Article 102 TFEU)

When determining whether a aviation related merger would have a negative effect on competition (EU Merger Regulation)

When determining whether a block exemption is applicable

Demand-side and supply-side substitution

The demand-side substitutability is the fundamental and most effective test to define the relevant market. According to section II paragraph 15 of the Notice:

“The assessment of demand substitution entails a determination of the range of products which are viewed as substitutes by the consumer.”

In contrast, the supply-side substitutability may be taken into account when defining markets in those situations in which its effects are equivalent to those of demand substitution in terms of effectiveness and immediacy. According to section II paragraph 20 of the Notice:

“This means that suppliers are able to switch production to the relevant products and market them in the short term without incurring significant additional costs or risks in response to small and permanent changes in relative prices.”

Point of origin / point of destination (O&D) pair approach

The European Commission and the European courts define the relevant product and geographic in the aviation sector, in most cases, on the basis of the ‘point of origin / point of destination’ (O&D) pair approach, according to which every combination of a point of origin and a point of destination should be considered as a separate market from the customer’s viewpoint; therefore following the principle of demand substitution (see Case C-66/86 Ahmed Saeed Flugreisen [1989] ECR 803, para 39 et seq and Case No COMP/M.3280 – AIR FRANCE / KLM, para 9 et seq).

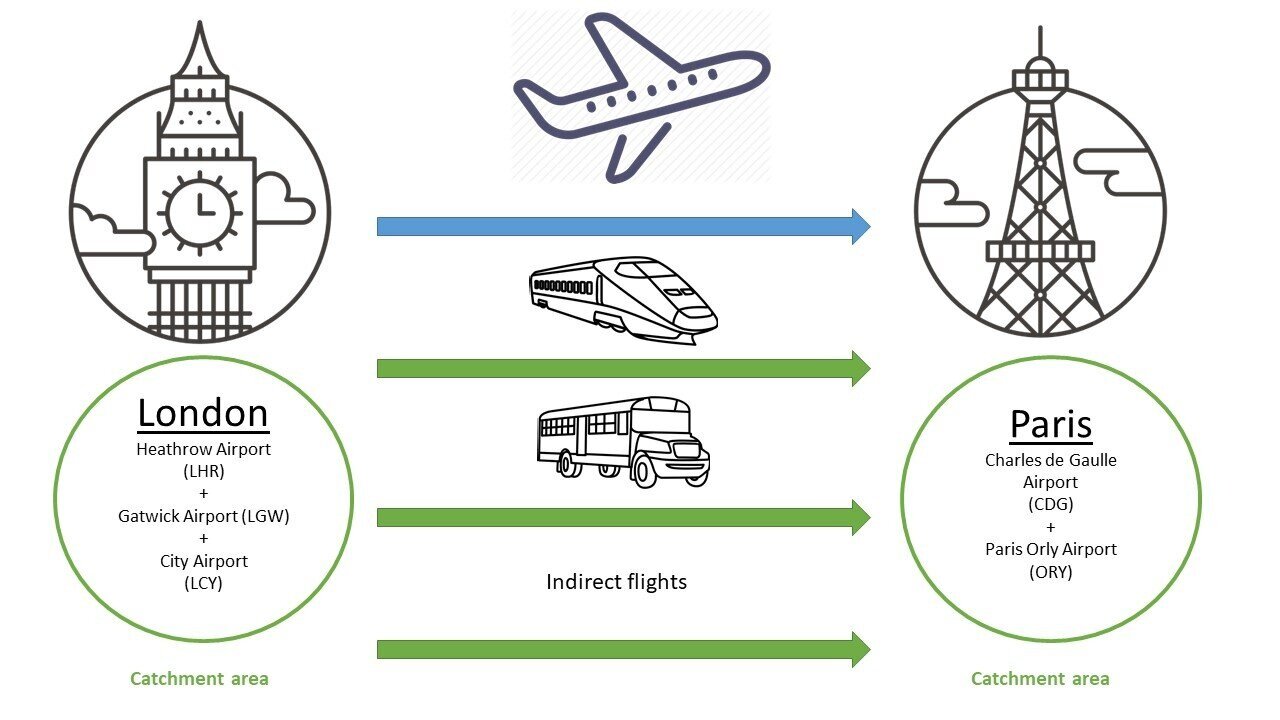

Consequently, according to the classic O&D pair approach the (flight) route between London Heathrow (LHR) and Paris Charles de Gaulle (CDG) constitutes a separate market.

Source: Aviation and Competition Law Research

Usually, the Commission looks at the different transport possibilities in that market, that is, not only at the direct flights between the two airports concerned (LHR and CDG), but also other alternatives to the extent that they are substitutable to these direct flights. Thereby, the model that is used today by the Commission and other competition authorities can be described as an extended version of the classic O&D pair approach.

These alternatives can be:

Direct flights between the airports whose respective catchment areas significantly overlap with the catchment areas of the airports concerned at each end (airport substitution)

Indirect flights between the airports concerned (only if the overall travel time is not to long)

Other means of transport, so called 'inter-modal substitution' (train, road, sea)

Source: Aviation and Competition Law Research

Further distinction by the European Commission

On a case-by-case basis, the European Commission regularly distinguishes between:

Long-haul flights and short-haul flights

Charter flights (bundled flights) and non-charter flights (unbundled flights)

Direct flights (e.g. A to B) and indirect flights (e.g. A to C to B)

Premium (time sensitive) passengers and non-premium (non-time sensitive) passengers

Supply-side substitution: Network competition?

Network carriers that operate a hub-and-spoke system usually argue that the market definition should take into account that the airline industry is characterised by network competition between airlines alliances. This rationale represents a supply-side perspective and reflects the business model of network carriers rather than the customer needs to be served. For the most part, the European Commission does not agree with this reasoning as the network approach is normally of little relevance to the individual consumer who wishes to travel from a point of origin to a specific point of destination (especially on short-haul flights).

However, the Commission sometimes does include effects of network competition in her overall competition assessment. In Case No COMP/M.3280 – AIR FRANCE / KLM, para 17 the Commission stated that

“Supply side considerations instead play an important role when considering the competitive constraint which individual carriers may exert on a certain market. The hub-and-spoke system determines the network carriers decision to operate (or not) a passenger air transport service on a particular O&D pair. Network airlines concentrate traffic into a specific hub and disperse passengers via connection to numerous spokes. This increases the load factor of aircrafts and allows airlines to exploit economy of density. They normally refrain from entering city pairs which are not connected to their respective hubs. At the same time the concentration on their hubs reinforces their position at these airports which often makes entry of competing airlines more difficult.”

The outcome: Complex market definition

Complex market definition questions can arise in aviation markets, particularly when competition authorities apply the point of origin / point of destination (O&D) pair approach. In practice, every flight route of the undertakings concerned has to be identified and considered as a separate market. In a second step, the overlapping routes of the undertakings have to be detected and examined for potential anti-competitive effects. Complicating matters further is the fact that the aviation industry is very dynamic and airlines can reorganise their business activities in a short time, meaning that competition authorities also have to take into account that airlines can ‘create’ new O&D pairs (and therefore new separate markets) by changing their flight schedule. Nevertheless, this ‘flexibility’ can be restricted by other parameters, such as slot availability at certain airports.