Daniel Metz* & Agnes Fischl**

ABSTRACT

The objective of this paper is to explain how environmental and sustainability aspects can be taken into account in European merger control. We explain why there is currently a need to take environmental and sustainability aspects into account in competition law and describe the legal framework for the application of such aspects in the area of merger control. We then develop a theoretical concept of a more sustainable approach and describe how this model could be applied to airline mergers. Finally, we argue that there is already a scope, albeit a narrow one, for the consideration of environmental and sustainability aspects in European merger control.

I. INTRODUCTION

For decades, there has been literature on how to take account of non-competitive considerations in competition policy.[1] In the field of European competition law, the Wouters judgment of the ECJ of 2002 is often cited to justify the consideration of general interests (in the context of Article 101(1) TFEU).[2] Nonetheless, a practical application of these considerations has so far remained only theoretical. This consideration was revived in the context of the Siemens/Alstom merger, which the Commission prohibited because of competition concerns, even though the merger was supported by policymakers on the basis of overriding general interests.[3] Following on from this, Germany and France published a joint manifesto for industrial policy in 2019, calling for more flexible European merger control, which should also include industrial policy considerations.[4]

Apart from these economic and political considerations, mankind is facing immense challenges caused by climate change. The new European Commission under Ursula von der Leyen, for example, has declared the European Green Deal, which aims to make the European Union climate-neutral by 2050, to be its top priority.[5] The following quote from Margrethe Vestager, Commissioner for Competition, should also be seen in this context: "Sustainability has gone from being something we talk about, to a central goal of policies around the world. All of Europe's policies - including competition policy - have a role to play to get us there.".[6] This raises the question of how environmental and sustainability aspects can be taken into account in competition policy.

A. Concept of competition and new challenges for competition policy

Competition policy is one of the most important areas of state regulatory and economic policy. The main purpose of competition law is to ensure and protect effective competition in the interests of consumers and businesses. However, a rational and science-based competition policy requires a clear and coherent agreement between political and economic actors on what competition is. The supposedly easy answer to this important question is more complex than one would expect, since the ideas of competition, parallel to the current economic and social order, are in a constant process of transformation.

The question then arises as to whether the current social and economic market conditions still correspond to the initial situation as they were at the time the concepts of competition were established. In contrast to the 20th century, which can be described as the starting point for the present competition concepts, two major changes in market conditions can be observed:

(i) The world population has risen since 1927 from around 2 billion to almost 8 billion people today, with a further increase of 2 billion people expected in the next 30 years.[7]

(ii) Climate change and the associated consequences require a strong reduction in CO2 emissions, also with a view to achieving the 2-degree objective of the Paris Agreement.[8]

On this basis, the following conclusions can be drawn for future competition policy: With steady population and economic growth, value chains must be designed to be climate-neutral. Companies must increasingly focus on new recycling technologies and improve their energy and resource efficiency. In addition, companies will have an increased capital requirement for research and the implementation of progressive environmental protection and sustainability measures. A stronger cooperation between companies will also become necessary.

In the sense of a classic market economy approach, it could now be argued that no state steering effects are necessary with regard to these changes, because companies, which do not operate in a resource- and energy-efficient manner, will not survive on the market in the long term. This argument, however, ignores essential market parameters. For a large number of products, the resulting environmental costs are not reflected in the price, but are incurred by the general public. This shifting of costs to the general public can lead to a distortion of prices. It should also be noted that existing steering models (such as the European Union Emission Trading Scheme) or market-inherent incentive systems (such as environmental protection as a competitive advantage over competitors) are often insufficient to achieve climate targets. In this respect, the thesis can be put forward that today's competition policy must pay more attention to sustainability and environmental protection aspects.

B. Contradiction between competition and environmental protection?

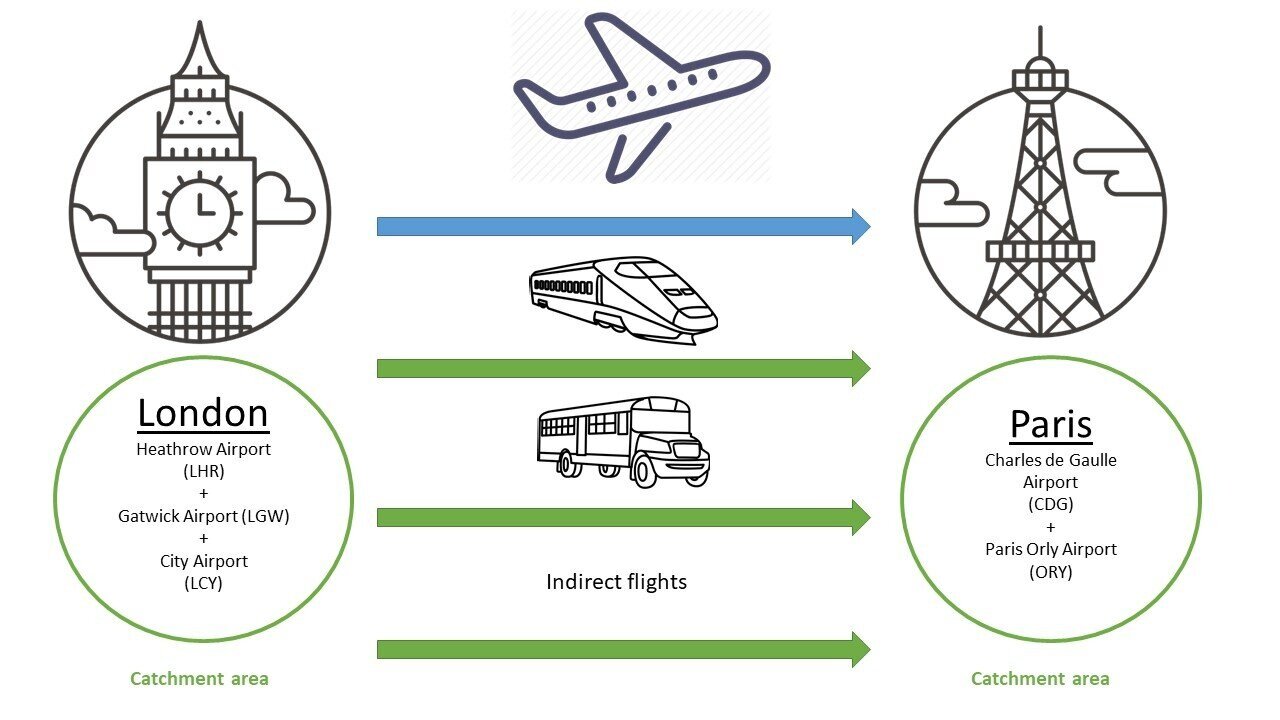

First of all, it should be noted that there is no inherent contradiction between competition and environmental protection, because environmental pollution is not a direct consequence of a market-based economic system, but is generally an imprint of an industrial social order. However, there are many interactions between competition and environmental protection, because both regulatory issues pursue the same ultimate goal, namely the optimal allocation of resources.[9] Furthermore, there may also be restrictions between competition and environmental protection. The degree of restriction depends on the specific implementation in each individual case. For instance, the likelihood of a restriction of competition through environmental protection measures will normally decrease the broader the scope of the environmental protection measure is defined. For instance, if an environmental protection measure only applies to one industry (e.g. air transport) but not to another industry (e.g. rail transport), the risk of a restriction of competition through this environmental protection measure increases.

II. ENVIRONMENTAL AND SUSTAINABILITY CONSIDERATIONS IN EU MERGER CONTROL

Article 2 of the EU Merger Regulation 139/2004 (EUMR)[10] contains the assessment basis for the substantive examination of concentrations with a Community dimension. According to Article 2(2) and (3) EUMR, it is decisive whether a merger would significantly impede effective competition in the common market or in a substantial part of it, in particular by creating or strengthening a dominant position. The significant impediment to effective competition, also referred to as SIEC test is the central material assessment criterion of European merger control.

The EUMR allows for the consideration of environmental and sustainability aspects, albeit in theory and within a narrow framework. According to Recital 23 of the EUMR, the Commission must be guided by the fundamental objectives of the European Union when assessing a merger. Recital 23 also explicitly refers to Article 2 of the Treaty establishing the European Community, which, inter alia, sets as objectives of the European Union the sustainable development of economic activities and a high level of protection and improvement of the quality of the environment. Academics support the inclusion of sustainability and environmental considerations in the examination of efficiency gains.[11] In this sense, sustainability and environmental factors could be assessed as possible efficiencies that outweigh the negative effects of a merger.[12]

In practice, however, no significant consideration of environmental or sustainability aspects has yet been given to merger control. Since the early 2000s, the European Commission has increasingly adopted a more economic approach in the implementation of its competition policy.[13] According to this approach, economic models are to be increasingly used for decision-making in competition law proceedings. A merger of companies is to be prohibited above all if it is highly likely to lead to rising prices and/or declining quality. Furthermore, there has never been a case in which a merger that led to a significant impediment to competition was cleared solely on the basis of efficiency gains.[14]

III. A CONCEPT FOR A MORE SUSTAINABLE APPROACH FOR MERGER CONTROL IN THE AVIATION INDUSTRY

The European Commission takes a fundamentally positive view of consolidation in the European aviation industry but examines concrete mergers of airlines very carefully.[15] Therefore, most airline mergers in Europe became subject to remedies.[16]

A. The problem of today’s merger control in the aviation industry

Taking the example of the strict merger control following the Air Berlin insolvency in 2017, which gave consumers the lowest air fares since 2012[17], it can be argued that the consistent application of merger control has clearly been successful, at least if one thinks within the current concept of competition and adopts its regulatory and evaluation apparatus. If one places consumer welfare in the sense of economic efficiency at the forefront of state competition policy, then a number of things have been done right in European air transport recently. But should consumer welfare, and therefore ultimately also price, be the primary assessment criterion for competition?

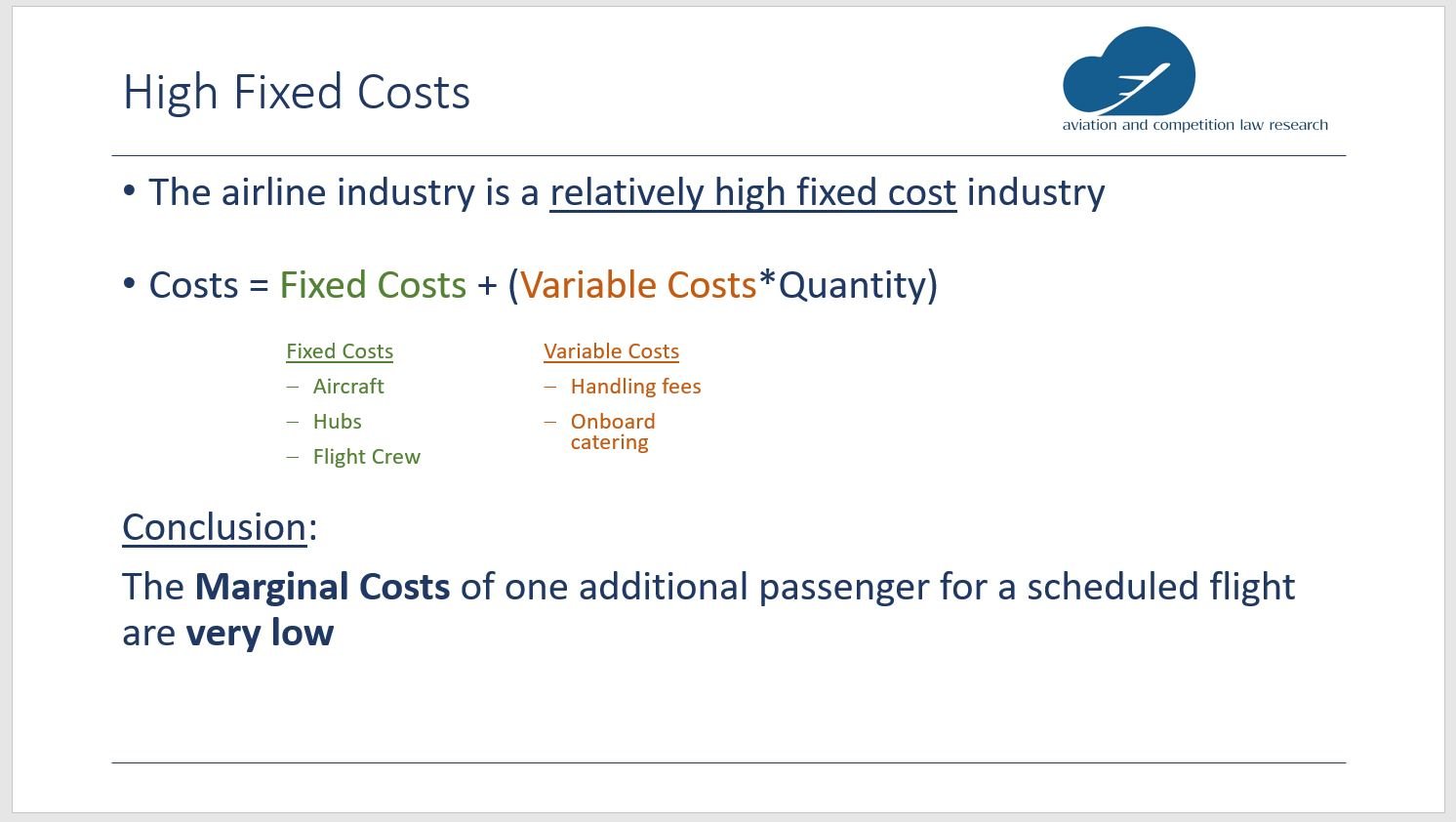

The downside of this competition policy is that parameters such as environmental protection and sustainability are only given secondary consideration. And since environmental goods are public goods, the resulting environmental costs are not reflected in the prices, but have to be borne by society. Even if they were serious about it, airlines find it difficult to include the overall environmental costs in their air fares because of the high level of price competition in the aviation industry.

It is therefore questionable whether a competition policy based purely on low prices for consumers hinders urgently needed climate protection measures? At least for the aviation industry, it can be argued that due to fierce price competition and low profit margins for airlines[18], there is little room for costly environmental and sustainability measures. For this reason, competition policy could reward airlines that nevertheless introduce progressive environmental protection and sustainability measures. In this sense, rewarding means that the implemented environmental protection and sustainability efforts are evaluated in terms of an overall assessment, for example in the case of a merger. This is not about removing competition concerns, but about creating incentives for environmental and sustainability measures.

B. Concept of a more sustainable approach

The concept of a more sustainable approach for merger control in the aviation sector could be oriented towards promoting and rewarding positive measures by airlines in the field of environmental protection and sustainability. This does not mean that airline mergers that raise competition concerns would now be cleared if the merging parties could demonstrate positive efforts in the area of environmental protection and sustainability. Rather, it is a question of taking into account aspects of environmental protection or sustainability in addition to known parameters such as market shares at airports or the number of slots as part of an overall assessment. In principle, these considerations would be possible (1) in the area of efficiencies or (2) in the area of remedies.

(1) Efficiencies

As discussed above, under the Commission's horizontal merger guidelines it is possible that the efficiencies generated by a merger may outweigh the resulting impediments to competition.[19] Efficiency gains are usually described in terms of purely economic competition parameters, such as cost savings or economies of scale.[20] However, it is questionable whether this view is not too narrow, i.e. too much reliance on purely economic parameters.

According to paragraph 76 of the horizontal merger guidelines: "Corporate reorganisations in the form of mergers may be in line with the requirements of dynamic competition and are capable of increasing the competitiveness of industry, thereby improving the conditions of growth and raising the standard of living in the Community".

Recital 4 of the EUMR also states: "Such reorganisations are to be welcomed to the extent that they are in line with the requirements of dynamic competition and capable of increasing the competitiveness of European industry, improving the conditions of growth and raising the standard of living in the Community".

It is therefore evident that the assessment of efficiency gains is ultimately based on living standards in the Union. And environmental protection and sustainability are undoubtedly part of the overall standard of living.[21] It can therefore be argued that environmental protection and sustainability factors can be seen as efficiencies in the broader sense. In order for efficiencies to be taken into account under the EUMR, they (i) must benefit consumers, (ii) be merger-specific and (iii) be verifiable.

(i) Benefit to consumers:

The benefit for consumers may arise from the fact that the merger of airlines may have positive effects on environmental protection or sustainability. Consumers benefit indirectly because, for example, they can profit from a reduction in CO2 emissions or sustainable business practices in the form of an improved quality of life. According to the horizontal merger guidelines, the efficiency benefits should be realized in time.[22] In the area of environmental protection measures, the focus should not be on the time of the (measurable) impact on the environment, but rather on the time when the environmental protection measures are taken. It is only important that, from an objective point of view, the environmental protection measures can ex ante lead to positive effects on the environment. In the case of a CO2 reduction as a result of a merger, positive effects would therefore probably have to be assumed in principle, which can already arise from the time of the first CO2 reduction. The same will apply to sustainable measures, such as the use of plastic-free materials.

(ii) Merger specificity:

The efficiencies must be a direct consequence of the notified concentration and must not be capable of being achieved to a similar extent by less anti-competitive alternatives.[23] A possible scenario could be the following: The large airline A, which does not have a specific environmental and sustainability policy, is economically weakened and is for sale. Airline B, which is a leading airline in the field of environmental protection and sustainability, wants to buy Airline A. The Commission takes a critical view of the merger because it would further increase the already high market shares of Airline B at certain airports. As a result of the merger, Airline B would introduce its advanced environmental and sustainability programmes to Airline A. For example, Airline B would invest in new low-emission aircraft for Airline A and extend its biofuel and zero-waste programme to Airline A. As a result, the merger would lead to efficiencies in environmental protection and sustainability. Merger specific efficiencies would be all the more significant if airline A operated in country X and airline B in country Y. The merger would lead to efficiencies in terms of environmental protection and sustainability measures in country X, which would ultimately improve the quality of life in country X and in the Union as a whole.

(iii) Verifiability:

The efficiencies have to be verifiable, such that the Commission can be reasonably certain that the efficiencies are likely to materialise.[24] Since the effects of environmental protection and sustainability measures are difficult to prove ex ante, the criterion of verifiability must not be applied too strictly.[25] It should therefore be sufficient for airlines to set out their environmental protection and sustainability measures and to provide an estimate of the positive effects on the environment based on current scientific criteria.

(2) Remedies

In the case of large mergers, it is common for the notifying parties to offer commitments to address the Commission's competition concerns.[26] The Commission may then grant clearance under Articles 6 and 8 EUMR, subject to conditions or obligations. As the primary purpose of such commitments is to remove the competition concerns raised by the notified concentration, it is in principle unlikely that behavioural commitments in relation to environmental and sustainability measures will be able to remove such competition concerns.

In practice, it is more likely that behavioural commitments regarding environmental and sustainability measures could be part of a package of commitments. In the aviation industry, for example, structural commitments, such as slot divestitures, are very often agreed.[27] It is feasible that behavioural commitments regarding environmental protection and sustainability measures could be combined with such structural commitments. This would make it possible to include environmental protection and sustainability aspects in merger control.

From a legal point of view, however, two problems arise: Firstly, it is questionable whether the Commission is not exceeding its competence by actively including behavioural commitments on environmental protection and sustainability measures for the purpose of promoting environmental protection. Secondly, it must be taken into account that such behavioural commitments with regard to environmental protection and sustainability measures can, in principle, never eliminate the concrete competition concerns of a merger. Such behavioural commitments can, at most, be a positive "add-on" to structural commitments (such as slot divestiture) and can be interpreted positively in a prima facie manner for an undertaking in the form of a goodwill. However, it is important to recognise that competition concerns (as in the past) are primarily removed only by "genuine" remedies.

IV. CONCLUSION

Already under the current EUMR regime, environmental and sustainability aspects could play a role in merger control. These aspects are most likely to be taken into account in the examination of efficiencies. However, it should be noted that environmental and sustainability aspects cannot, in principle, remove competition concerns. On the contrary, environmental and sustainability aspects could become more important in the context of a comprehensive balancing of possible positive and negative effects. It is therefore a question of extending the catalogue of balancing criteria to include environmental protection and sustainability aspects, because the Commission generally examines mergers from a strictly economic point of view. Ultimately, the question of integrating environmental protection and sustainability aspects into competition policy is also a political question, because it concerns the hierarchy of European Union law. Does European competition law only serve competition as such or possibly higher-ranking objectives of the European Union such as those of environmental protection or the standard of living of its citizens? In this sense, where there's a will there's a way!

* Daniel Metz is a graduate student at the Faculty of Law of the University of Vienna and founder of ‘Aviation and Competition Law Research’, a non-profit research organisation for competition law issues in the aviation industry.

** Agnes Fischl is a researcher at Aviation and Competition Law Research and has been involved in sustainability research for many years.

[1] For example Miriam Lenz, The interplay between the environment and competition law in the EU: an analysis of environmental agreements and their assessment under Article 81 EC (2000); Suzanne Kingston, The Role of Environmental Protection in EC Competition Law and Policy (2009).

[2] See further Case C-309/99 Wouters v Algemene Raad van de Nederlandse Orde van Advocaten [2002] ECR I-1577.

[3] See Siemens/Alstom (Case M.8677) decision of 6 February 2019.

[4] A Franco-German Manifesto for a European industrial policy fit for the 21st Century (19.02.2019) <https://www.bmwi.de/Redaktion/DE/Downloads/F/franco-german-manifesto-for-a-european-industrial-policy.pdf?__blob=publicationFile&v=2>.

[5] Communication on The European Green Deal, COM(2019) 640 final (11.12.2019) <https://ec.europa.eu/info/sites/info/files/european-green-deal-communication_en.pdf>.

[6] Tweet of Margrethe Vestager regarding the GCLC Conference on Sustainability and Competition Policy (24.10.2019) <https://twitter.com/vestager/status/1187308316973850625?lang=de>.

[7] United Nations, World Population Prospects 2019.

[8] See further Paris Agreement under the United Nations Framework Convention on Climate Change (22.04.2016).

[9] Jose´ Carlos Laguna de Paz, Protecting the Environment Without Distorting Competition (2012) Journal of European Competition Law & Practice, 2012, Vol. 3, No. 3, p 249.

[10] Council Regulation (EC) No 139/2004 of 20 January 2004 on the control of concentrations between undertakings, Official Journal L 024, 29/01/2004 P. 0001 – 0022.

[11] See Suzanne Kingston, The Role of Environmental Protection in EC Competition Law and Policy (2009) 222;

Simon Holmes, Climate Change, Sustainability and Competition Law (Draft 26/09/2019) 23.

[12] See further Guidelines on the assessment of horizontal mergers under the Council Regulation on the control of concentrations between undertakings (Horizontal merger guidelines) 2004/C 31/03, para 76-88.

[13] See further Nadia Calvino, When do Mergers Raise Concerns? An Analysis of the Assessment Carried out by the European Commission under the New Merger Regulation (2011) Journal of European Competition Law & Practice, 2011, vol. 2, no. 6, pp 521-528.

[14] See Richard Whish/David Bailey, Competition Law (Ninth Edition 2018) 898.

[15] See Lucia Bonova/Dagmara Koska/Axel Specker, Consolidation of the EU airline industry: How the Commission kept seatbelts fastened in the 2009 airline merger wave (2009) Competition Policy Newsletter, Number 3 – 2009, pp 53-57.

[16] See further Frank Fichert, Remedies in Airline Merger Control – The European Experience (2011), in Szeto, W.Y. / Wong, S.C. / Sze, N.N. (eds.), Transportdynamics, Proceedings of the 16th International Conference of Hong Kong Society for Transportation Studies, Hong Kong, pp 359-366.

[17] See further German Aviation Association (BDL), The annual state of the industry: Report for the first half of 2018, 9 August 2018, p 5, <https://www.bdl.aero/wp-content/uploads/2018/08/bdl_halbjahresbilanz_2018_Pr%C3%A4sentation-1.pdf>.

[18] See further IATA, Profitability and the air transport value chain, Economic Briefing No 10.

[19] Horizontal merger guidelines, para 76-88.

[20] Horizontal merger guidelines, para 80.

[21] See Article 3(3) of the Treaty on European Union, which explicitly mentions "a high level of protection and improvement of the quality of the environment".

[22] Horizontal merger guidelines, para 79.

[23] Horizontal merger guidelines, para 85.

[24] Horizontal merger guidelines, para 86.

[25] Simon Holmes, Climate Change, Sustainability and Competition Law (Draft 26/09/2019) 24.

[26] See further See Richard Whish/David Bailey, Competition Law (Ninth Edition 2018) 907.

[27] See further Frank Fichert, Remedies in Airline Merger Control – The European Experience (2011), in Szeto, W.Y. / Wong, S.C. / Sze, N.N. (eds.), Transportdynamics, Proceedings of the 16th International Conference of Hong Kong Society for Transportation Studies, Hong Kong, pp 359-366.